Rachel Mersky, CPA is a private accounting tutor specializing in the CPA exam and college accounting courses. Rachel also offers resume and career consulting for individuals entering or working in the accounting industry. She has over a decade of experience in both public and private accounting. Rachel can be reached on LinkedIn and Facebook and you can also view her website at: www.rmtutor.com

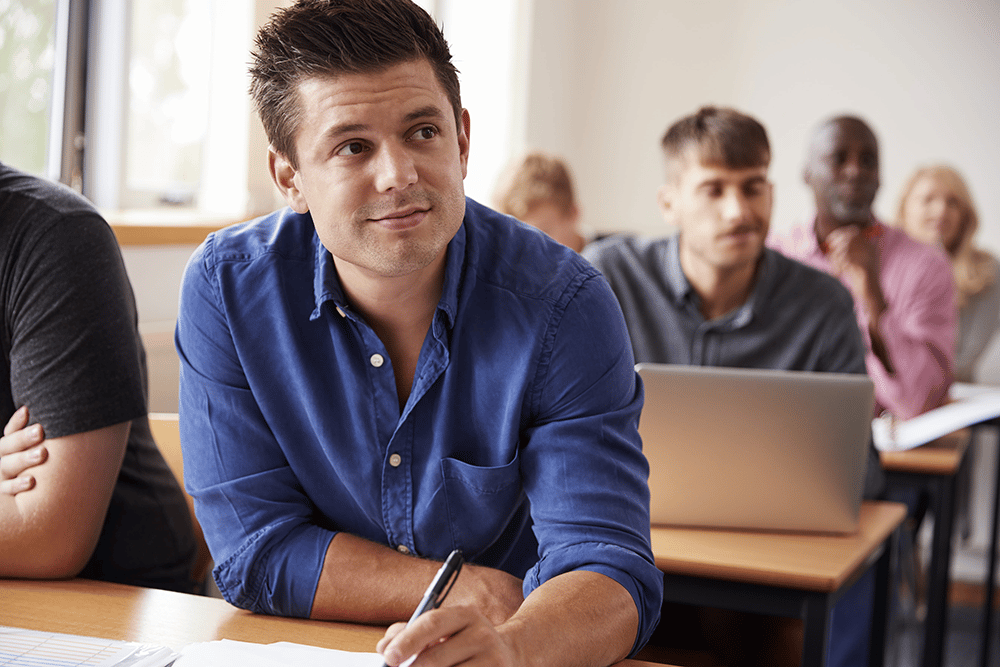

If you’re feeling overwhelmed or confused in trying to choose the right career (or change in career), know that you’re not alone.

Would you get dressed in the morning with a blindfold on— hoping you made an appropriate choice but not totally sure? Of course not!

That’s why choosing a career path is extra difficult. You haven’t yet had the chance to really “see” what it’s like, so it’s almost as if you’re choosing blindly.

Yes, you may have taken a “What Career is Best for Me” personality test. Furthermore, you’re likely aware of your ideal learning style if you’ve read my previous article. However, there’s so much more to determining what suits you. The best strategy I can suggest is to do your research, talk to as many people in different industries as you can, and try it out! Ask someone in a profession you’re interested in if you can shadow them, or even better, get an internship in a field you’re interested in.

As a CPA exam tutor, I can tell you that choosing your career path can be the start to a journey that leads you in a direction you did not expect or plan for. After working in both public and private accounting, I chose to change gears and focus on the education side of accounting.

All my roles have had pros and cons and I’ve learned different things from each of them. If you’re interested in an accounting career, I am happy to share details of my experience – feel free to send me an email!

Also, remember that just because you make a choice does not mean it’s forever! You may evolve and grow and find yourself taking on new and different opportunities. And sometimes, you may learn that what you chose is not for you and decide to change your path completely.

The bottom line is, although it seems like THE most important decision you’ll ever make, don’t stress too much – whether you choose a career in accounting or something else, you are gaining important skills that you’ll use throughout your life and career. Nothing about that is a poor choice!

CPA Exam FAQ

Read below for my answers to some FAQs about a career in accounting and obtaining a CPA license:

What is a CPA and what does CPA stand for?

A Certified Public Accountant is a professional accountant who has passed the CPA exam and met the requirements (education and experience) to be licensed.

What does a CPA do?

A CPA is a trusted professional who helps their clients achieve their financial goals. There are many different areas of accounting where a CPA may work, including:

- CPA firm— you can either work for a firm or have your own firm in any of the following roles.

- Auditors: Perform financial statement and internal control audits

- Tax accountants: Prepare tax returns for individuals and corporations as well as advise clients on tax related matters

- Consultants: consult on accounting/finance related matters to help companies with their decision-making

- Forensic accountants: investigative accounting most commonly related to fraud, divorce, etc. May also provide expert testimony in court.

- Financial planning: advise clients on various financial matters, including investment planning

- IT auditor: evaluate internal controls and systems risks and perform systems audits

- Public or private company— you can work “in-house” in a company’s accounting department as one of the following roles:

- CFO: lead the accounting department

- Controller: assist CFO in leading the accounting department and prepare certain external reports, including financial statements

- Accounting staff: record accounting entries and prepare internal and external reports

- Internal auditor: evaluate and improve internal controls and business processes

- Governments/Nonprofits: you can work at either of these in the same types of roles as above for public/private companies.

Education/Other: you can work as a college professor, private tutor, recruiter, etc.

Why should you become a CPA?

There are many advantages to becoming a CPA versus working as an accountant without the CPA designation. Being a CPA opens doors to many opportunities, including higher pay rates and leadership roles/promotions. Furthermore, this title provides increased job security. In many CPA firms, you are not eligible for certain promotions without having your CPA license. You’re also not allowed to perform certain jobs such as signing off on a public company audit report or tax return.

When working in a service industry, potential clients may be more inclined to trust you and work with you if you are a licensed CPA. Finally, it results in a major sense of accomplishment – after passing the HARDEST exam out there, you’ll feel on top of the world!

How do you become a CPA and how long does it take?

In order to take the CPA exam, you must have completed at least 120 or 150 credit hours depending on your state (this must include certain accounting courses). In order to be licensed you must pass all four parts of the CPA exam, complete at least 150 credit hours, and meet your state’s work experience requirement (typically one year).

When it comes to the actual exam, you must pass all four parts within an 18-month timeframe. The exam is available to be taken at Prometric testing centers on any date except for blackout dates:

- March 11 – March 31

- June 11 – June 30

- September 11 – September 30

- December 11 – December 31

Once you pass your first exam you have 18 months to pass the rest. If after 18 months you haven’t passed the rest, you lose your first passing score. This continues on until you’ve passed all four parts within an 18-month window. Once you’ve completed all the requirements to become a licensed CPA, you’ll need to obtain the required continuing professional education (CPE) requirements annually.

To answer the question of how long it takes to become a CPA – it varies. If you take the most straightforward route, it should take you approximately 6.5 years. That’s 4 years for a bachelors’ degree, 1 year for a masters’ degree, and 1.5 years to pass the CPA exam while simultaneously working.

Is the CPA exam worth it?

In my opinion, YES! As discussed in #3 above, there are so many positives that result from becoming a licensed CPA. That comes at a cost though – you’ll have to spend a lot of money (on the exam, prep course, tutor, etc.) and you’ll have to dedicate a LOT of time and energy to studying. The days and nights spent studying are only temporary, but (as long as you keep up with CPE credits) you’ll have your CPA forever.

How many parts are in the CPA exam?

There are four parts to the CPA exam broken down below:

- FAR: Financial Accounting and Reporting

- REG: Regulation (Tax & Business Law)

- AUD: Audit

- BEC: Business Environment & Concepts (includes: Economics, Cost Accounting, IT, etc.)

Each part has a four-hour time limit and is made up of five testlets. Once you complete each testlet, it will close, and you cannot go back to it. For FAR, REG, & AUD, the first two testlets are multiple choice questions (MCQs) and the last three testlets are task-based simulations (TBSs). BEC is made up of two MCQ testlets, two TBS testlets, and one writing comprehension (WC) testlet at the end.

What is the CPA exam like? What should I bring?

You’ll take the CPA exam at a Prometric testing center (where people can come to take any professional exam). Bring your NTS and a photo ID. You will be provided with a locker to keep your belongings and are allowed to bring only the locker key and your ID into the testing room.

After a security check-in, the staff will show you to your seat and provide you with a dry erase board and marker to use during the exam. Once you begin, there will be a few intro screens for you to go through. Be aware that these screens are timed. If you don’t move through them within the time limit, your exam will end and you won’t be able to restart it.

Once you’ve completed the intro screens you’ll be ready to begin the four-hour exam. You will have a 15-minute break midway through the exam that doesn’t take away from the four-hour time limit. If you choose to take additional breaks, they will count against your time.

- Multiple choice questions will require you to choose from options A-D.

- Task based simulations are more complex – almost like a case study. They’ll provide you with documents related to the question; you’ll be required to either choose answers from a dropdown menu, fill in some sort of table, chart, or statement, etc.

- Writing comprehension questions will prompt you with a topic and you’ll be asked to write a short memo or letter responding to it.

Regardless of whether you are able to come up with the proper content, make sure that you format your written response properly – that will still earn you points.

How many times can I take each exam?

You can take each exam as many times as you want! Hopefully you won’t need to, but if you don’t pass the first time, it’s ok. You’re allowed to take as many sections per testing quarter as you’d like. However, you may not take the same exam section more than once in the same testing quarter. That means you can take all four parts between January 1 and March 10 if you wanted to, but you can’t take FAR twice in that same window.

How hard is the CPA exam?

I’m not going to lie; this exam is really tough! It’s been said to be the hardest professional exam out there. According to the AICPA, there’s an approximately 50% pass rate on each section. You may be at an advantage if you’re a recent college grad and all that accounting knowledge you’ve learned is still fresh in your mind. Also, if you’ve been in the accounting field for some time, you’ll be at an advantage as well; you can understand it from a “real-life” perspective.

How is the CPA exam scored?

In order to pass each exam, you need a score of 75 or better. For FAR, REG, & AUD, MCQs will be 50% of your grade and TBSs will be 50% of your grade. For BEC, MCQs will be 50% of your grade, TBSs will be 35% of your grade, and WCs will be 15% of your grade. Harder questions will be weighted heavier than easier questions (meaning if you get a hard question right, you’ll get more points for it than getting an easy question right).

If you notice your testlets getting harder, that’s a good sign! If you do well on the first testlet, the second one gets harder, and so on. If you notice they’re getting easier, don’t worry! Each testlet is a chance for you to do well regardless of how hard it is.

Scores are released approximately four times per window. Depending on when during the testing window you take your exam, you’ll have to wait somewhere between one and five weeks to find out your score. For this reason, some people like to take their exam towards the end of the scoring window.

Which part is the hardest? Which is the easiest?

There’s no right answer to this question, since it really depends on you! FAR covers the most material and BEC covers the least, but if you’ve been working in an accounting department where you’re responsible for recording entries and reporting, you’ll be more familiar with the material in FAR. If you work in government or nonprofit accounting, you’ll also be more prepared for FAR. So, even though it’s the biggest and most intimidating, you may have a leg up if it’s your specialty.

The same goes for AUD and REG. If you’re an auditor or tax accountant, then those respective exams may be your easiest. Since BEC covers the least amount of material and has less simulations, that one is easiest for many people. However, many of my students say that it’s the hardest for them since it includes a variety of random topics that are trouble spots for most (like cost accounting and IT). Although this answer may not seem helpful, just know that you are capable of CRUSHING them all regardless!

Are CPA exam fees tax deductible?

No, unfortunately they aren’t. The IRS considers the CPA exam as preparing you for a new trade or business, which is not allowed as an itemized deduction.

Did we miss any questions?

If so, leave your CPA-related questions in the comments section and we’ll do our best to answer them!

Compare The Best CPA Review Courses

Get Discounts on CPA Review Courses!

Extended Sale – $1,346 Off Becker CPA Pro+

Save $1,249 On Gleim CPA Traditional

Take $1,600 Off UWorld CPA Elite-Unlimited Course

Save $629 Surgent CPA Ultimate Pass

Enjoy $1,050 Off Gleim CPA Premium Pro Course

Extended Sale – $1,000 Off Becker CPA Concierge

Extended Sale – $1,345 Off Becker CPA Pro

Take 40% Off Gleim CPA Premium

Exclusive Offer – 30% Off Lambers CPA Course Package

Get CPA Evolution Ready Content on All Becker CPA Courses – Deal

Becker CPA Advantage Package Now $2,499 – Promo

Enjoy a 14-day Free Trial on Becker CPA Courses

Becker Deal: Save on CPA Single Part Courses

Becker CPA: Interest-Free Payment Plan – Deal

Bryce Welker is a regular contributor to Forbes, Inc.com, YEC, and Business Insider. After graduating from San Diego State University, he went on to earn his Certified Public Accountant license and created CrushTheCPAexam.com to share his knowledge from reviewing hundreds of accounting courses while helping thousands of other accountants become CPAs. Bryce was named one of Accounting Today’s “Accountants To Watch” among other accolades. As Seen On Forbes