Numbers are important. Just about every aspect of our lives can be tracked and understood with numbers. Furthermore, this information can be harnessed in order to solve major problems and improve the lives of ourselves and others.

Put simply, numbers are a big deal, especially if you want to work as an accountant!

Are you interested in a career as a Certified Public Accountant? If public accounting is something that interests you, it’s a good idea to start getting acquainted with statistics early. And what better way to learn than to take a look at CPA statistics?

So keep reading to learn what the numbers have to say about professional accountancy. The fascinating facts found below contain information that will greatly assist you in making the best decisions possible when planning out your future career. Check it out!

CPA Education Statistics

In order to learn more about the numbers behind CPA education, we looked to the American Institute of CPAs (AICPA) and studied their published reports. In particular, their 2019 Accounting Graduates Supply and Demand Report provides a fantastic reference point for the state of public accounting education.

Most Common Educational Program for CPAs

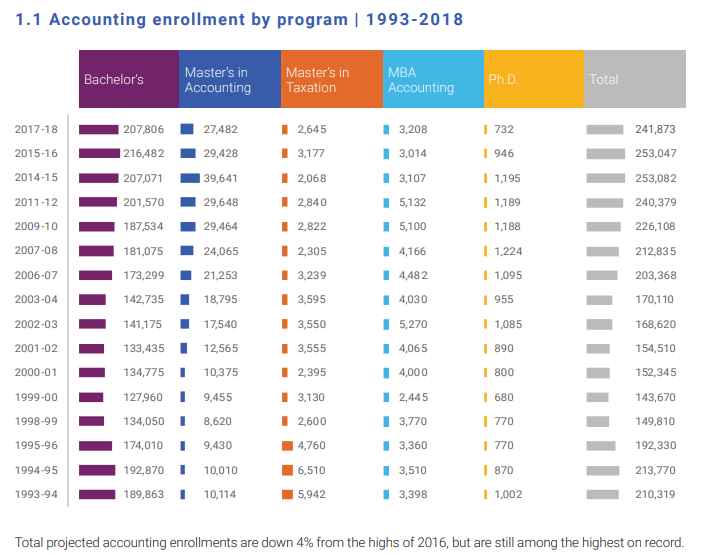

What’s the most common educational program for accounting that aspiring CPAs (and similar professionals) pursue? To answer that question, we’ll need to consult this chart on page 6 of the AICPA report:

This chart tracks the number of enrollees for numerous accounting programs relevant to the CPA designation over the past 20+ years. Based on this data, it appears that the most common education for CPA candidates is a Bachelor’s degree by a significant majority. This has been consistent for the entire time period tracked by the AICPA, with an all-time high of 216,482 enrollees in 2015-2016. Ultimately, this trend makes logical sense; it’s the easiest way for candidates to meet the 150 education hours required in order to qualify for licensure.

Unsurprisingly, a Master’s degree in accounting is the second most popular program for CPA candidates, with an all-time high of 39,641 enrollees in 2014-2015. But why is this the case?

Although a Master’s degree in accounting is a fantastic educational basis for becoming a CPA, it does take more time and money than the most popular option. Furthermore, it stands to reason that most Master’s students have loftier career goals than just public accounting and may be pursuing upper management positions instead.

Least Common Educational Program for CPAs

Not surprisingly, the AICPA chart data reveals that the least common educational path for enrollees is the most difficult and selective of them all: a doctorate. The least common education level for CPA candidates is a Ph.D. with an all-time high of 1,195 enrollees in 2014-2015. This is most likely due to the fact that professionals at this level of education have much more lucrative career paths — just like Master’s degree holders — with the majority of them being related to education and academic research.

Male vs. Female Accounting Enrollment and Graduation

The AICPA offers specific statistics based on gender in their 2019 trends report that can help us to identify a potential issue facing this industry— gender representation.

Here’s what the numbers have to say:

Is there a gender gap in accounting degree enrollees? Not really. According to the graph above, 207,806 students enrolled in Bachelor’s degree programs and 27,482 enrolled in Master’s programs in 2017-2018. Page 11 of this same report states that 51% of these Bachelor’s degree candidates were male and 49% were female: a 2% difference. When it comes to postgraduate education, however, it’s split exactly down the middle, with 50% male and 50% female Master’s degree enrollees. For the most part, it’s fair to say that representation of accounting students is equal based on gender.

However, enrollment is one thing; graduation is another issue entirely. Is there a gender gap among accounting graduates?

For the most part, no; however, there is one gap that’s different from what you may expect!

Page 6 of the AICPA report states that the number of Bachelor’s and Master’s of accounting graduates for 2018 is 76,542: 54,947 Bachelor’s degree and 21,595 Master’s degrees. Then, this report outlines the percentage of men and women who earned these degrees. For Bachelor’s graduates, it’s an even split at 50% male Bachelor’s graduates and 50% female. However, there is a 6% difference between male and female Master’s degree graduates: 47% male and 53% female.

At this point, it’s difficult to discern exactly why this post-grad gap exists. However, further examination of gender-based CPA statistics may help us to understand what’s going on.

CPA Exam Statistics

To find out more about the intricacies of the CPA exam, we poured through information collected by the National Association of State Boards of Accountancy (NASBA). In particular, many of these numbers were derived from the most recently published University and Jurisdiction editions of their annual NASBA Report.

Furthermore, some of the information gathered from these resources compare men and women. According to page 8 of the 2017 NASBA Report, Jurisdiction Edition, “Gender information was available for 97.6% of candidates sitting for the Exam” that year. This means that the gender-related information contained here doesn’t paint the entire picture, but it does come extremely close!

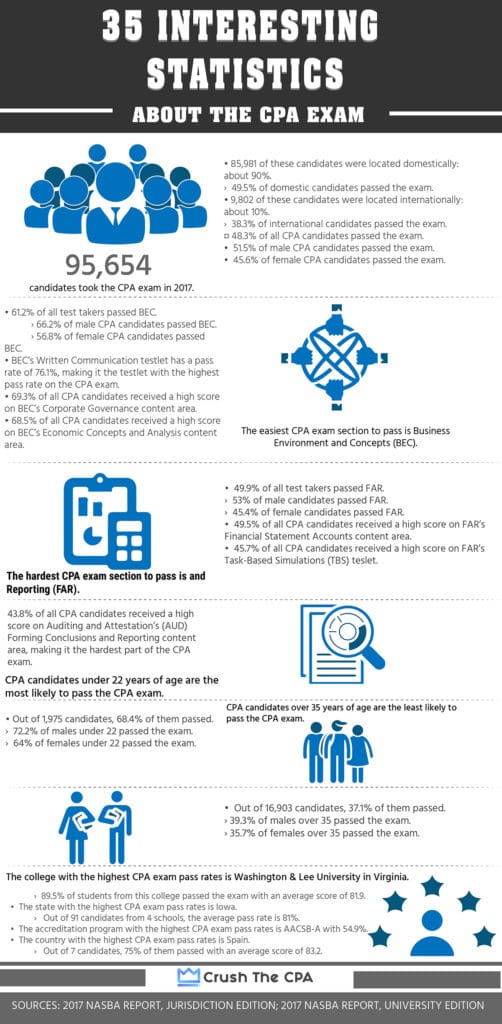

Take a look at these CPA exam statistics below:

CPA Exam Pass Rates

According to page 13 of the 2017 NASBA Report, Jurisdiction Edition, 95,654 candidates took the Uniform CPA Examination that year. Of these test takers, the percentage of those that passed was 48.3%: just less than half.

For males, the CPA exam pass rate in 2017 was 51.5%. For females, the 2017 CPA exam pass rate was 45.6%. This data seems to suggest that women have a harder time passing the exam than men; however, the specific reasons as to why this is the case is still unclear.

Easiest CPA Exam Section

What constitutes the “easiest” exam section of the CPA? For the sake of this article, we’re going to consider the section with the highest passing rate to be the easiest.

Fortunately, this information can also be found on page 13 of the 2017 NASBA Report, Jurisdiction edition. According to this resource, the highest CPA pass rates were for the Business Environment and Concepts (BEC) section: 61.2% of all test takers passed with an average score of 75.1. The male BEC pass rate is 66.2% with an average score of 77, and the female BEC pass rate is 56.8% with an average score of 73.5, based on information found on page 127 of the same report.

What makes BEC the easiest section of the CPA exam? The NASBA Report gives us two clues. The first is the inclusion of a Written Communication Task section, which is something exclusive to this section. This written portion makes up 15% of the final BEC score for all CPA exam candidates, and it has the highest pass rates of each individual testlet: 76.1%.

Here’s the second clue:

Out of the 18 content areas that make up the CPA exam, the 2 that students receive a “Comparable” or “Stronger” rating on most often can be found in the BEC section. These two sections are Corporate Governance (69.3%) and Economic Concepts and Analysis (68.5%). Consequently, it appears that these content areas are the easiest for CPA candidates to pass, either because of the candidates’ exam readiness or because of the content of the exam itself.

Hardest CPA Exam Section

Based on the same metrics and data sets found in the Jurisdiction edition of the 2017 NASBA Report, it appears that the hardest exam section is Financial Accounting and Reporting (FAR).

The average pass rate for this section is the lowest of the four at 49.9%. Furthermore, the average CPA exam score for FAR among all test takers is below passing: around 68.6. According to page 127 of the NASBA Report Jurisdiction Edition, female test takers have a FAR pass rate of 45.4% and an average score of 67.1. Males have it a bit better with a FAR pass rate of 53% and a 70.3 average score; however, neither of these average scores are passing.

Surprisingly, the pass rates for FAR’s individual content areas aren’t as low as you may have expected, considering the low pass rates for this section overall. The two content areas on the FAR exam with the lowest rates of “Comparable” or “Stronger” ratings for all candidates are Financial Statement Accounts (49.5%) and Task-Based Simulations (45.7%). Neither of these are the lowest out of all 18 CPA Exam content areas; that honor goes to Forming Conclusions and Reporting (43.8%) on the Auditing and Attestation (AUD) section.

Why is FAR the hardest section of the CPA exam to pass if the content areas contained aren’t the hardest on the exam itself? Here’s the smoking gun:

Referring back to the American Institute of CPAs’ (AICPA) exam scoring rubric, the Task-Based Simulation (TBS) section of each exam part is weighted heavily in students’ final scores. In the case of BEC, this weight is slightly offset by the inclusion of a written portion. However, FAR has no written portion and the most difficult TBS portion. Hence, the pass rates for this section of the exam sink like a stone despite decent average scores for the majority of its content areas.

Best Age for Passing the CPA Exam

Does wisdom come with age? According to the information contained in the NASBA Report, not when it comes to passing the CPA exam!

According to page 13 of the 2017 Jurisdiction Edition, CPA candidates with the highest pass rates are those younger than 22 at 68.4%. Furthermore, this is the case for both men and women taking the exam in this age bracket. According to page 127 of this report, their pass rates are 72.2% for males under 22 and 64% for females under 22.

Why is this the case? Here’s the most likely explanation:

The main reason for this high percentage is that there aren’t many CPA candidates under 22 years old in the first place. After all, the AICPA requires 150 semester hours of accounting education and 1-2 years experience working under a CPA before even becoming a candidate. Naturally, this process is extremely time-consuming and necessitates a strong background in accounting, which is difficult to accomplish at a young age.

Ultimately, this would explain why <22 CPA candidates make up the smallest age bracket out of all CPA candidates in 2017: 1,975 in total, according to the NASBA Report. When put in that perspective, it’s easier to understand the comparatively high pass rate. Most likely, this statistic has less to do with any youthful advantage and more to do with limitations on what the data set can tell us when working with such a small population pool.

Worst Age for Passing the CPA Exam

On the other hand, the idea that youth is an advantage when taking the CPA exam seems to have merit when considering the opposite end of the spectrum: those who did the worst on the exam. In this case, the 16,903 CPA candidates age 35 and older had the lowest pass rate of 37.1% and the lowest average score of 67. For males, that pass rate is 39.3%; for females, the pass rate is 35.7%.

So what gives? Why do the oldest aspiring CPAs have the toughest time passing the exam? It isn’t as though they’re senile; the average age for candidates in this bracket is 42 years old. Additionally, the total population of test takers in this bracket aren’t disproportionate with other brackets, as is the case with the youngest crowd.

The most likely reason for this significant drop-off is the fact that most older test takers have been out of college for a long time. As a result, the accounting and taxation information isn’t fresh in their minds as it would be for a more recent college student or graduate. Consequently, their exam scores suffer as a result. A potential workaround for older CPA candidates who wish to avoid this issue is enrolling in a CPA exam prep course to brush up on their knowledge before test day.

Colleges With the Highest CPA Exam Pass Rates

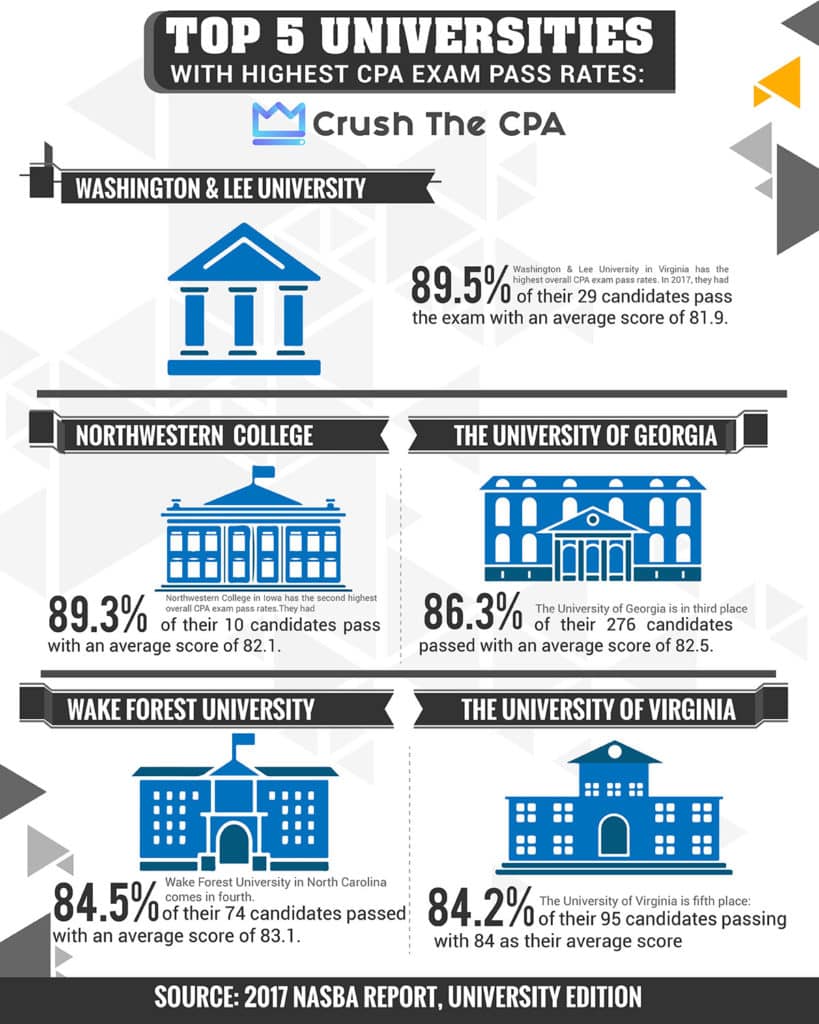

Based on the aforementioned semester hour requirements for becoming a CPA exam candidate, it goes without saying that just about every single test taker is a former or current college student. But which college is the best at preparing their students to pass the CPA exam? To answer this question, we’ll have to take a look at the University Edition of the 2017 NASBA Report.

Source: 2017 NASBA Report, University Edition

Something that becomes clear when looking at this data is the fact that the top schools for aspiring accountants have some of the fewest CPA candidates. The most likely explanation for this is that these schools are extremely selective when it comes to accepting students into their accounting programs. Hence, you’re going to want to do everything you can as early as possible to meet their approval if you want to be accepted into these top-tier schools!

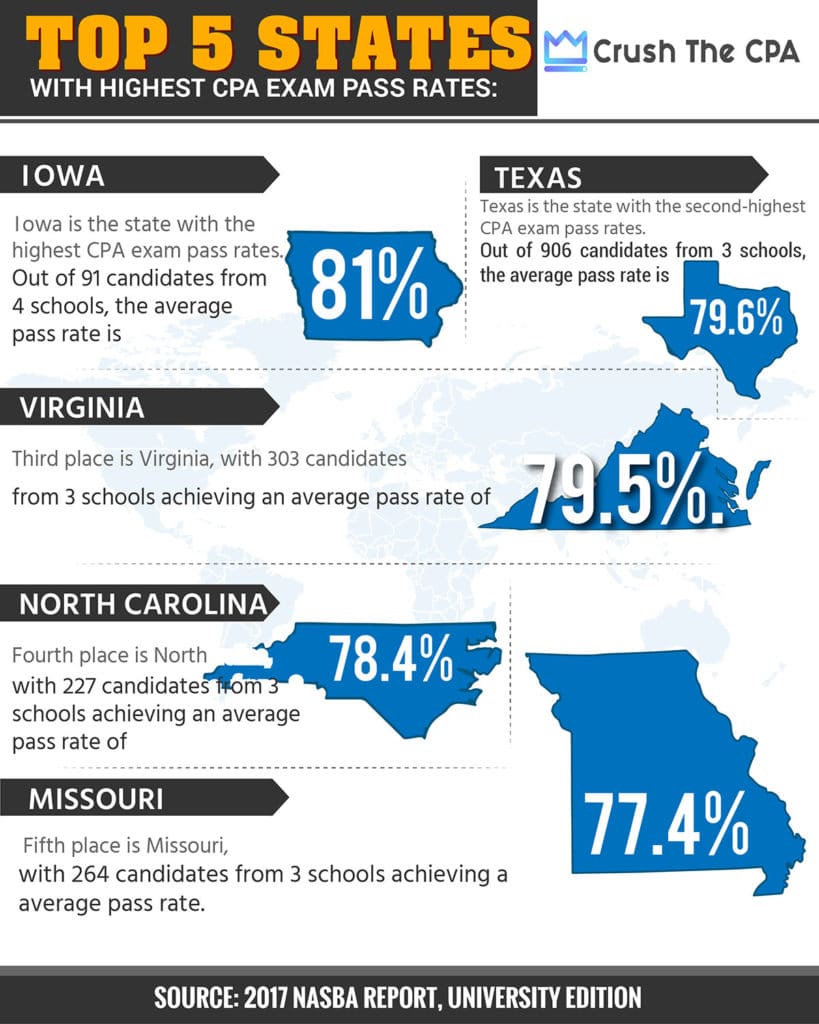

States With the Highest CPA Exam Pass Rates

Which state’s schools are the best for a CPA candidate if they want to have the highest chance of passing the CPA exam? Answering this question is difficult, even with the aid of the 2017 NASBA Report. However, there is some data found in the University Edition that helps to paint a clearer picture:

Truthfully, even this data doesn’t paint anywhere near a clear enough picture to authoritatively answer this question. After all, the calculation process for these averages involved data that had already been averaged, increasing the margin of error. Furthermore, this data doesn’t include candidates or pass rates for all the schools in each state: just those from the top 40. Finally, you might object to the entire premise of calculating pass rates to assume that simply living in a given state will increase your chances of passing the exam.

However, there are some reasonable inferences we can make about this data that can inform undergraduates when determining their institution of choice. For instance, one idea they might take away from these findings is that some of the best CPA exam takers came from highly selective accounting programs in Iowa. Another potential takeaway is that the largest population of successful CPA candidates can be found in Texas. Do with this information what you will!

Accreditation Programs with the Highest CPA Exam Pass Rates

Let’s say you’re unable to attend one of the high-ranking colleges in one of the top-rated states. If you can’t land a spot in a top-tier accounting program in Iowa or Virginia, does that mean all is lost?

Not necessarily! You see, the University Edition of the 2017 NASBA Report also tracks the performance of candidates by another metric: accreditation programs. Consequently, we can determine whether or not a particular school is better suited for preparing students to pass the CPA exam based on the program they’ve implemented. Check it out:

What does this mean for the average undergraduate? Well, if you find yourself unable to be accepted into one of the top-rated schools in one of the most successful states, a great safety choice is to enroll in a university that offers business and accounting programs with accreditation from AACSB. You can learn more about these universities (which can be found all over the world) through their website.

Speaking of “around the world…”

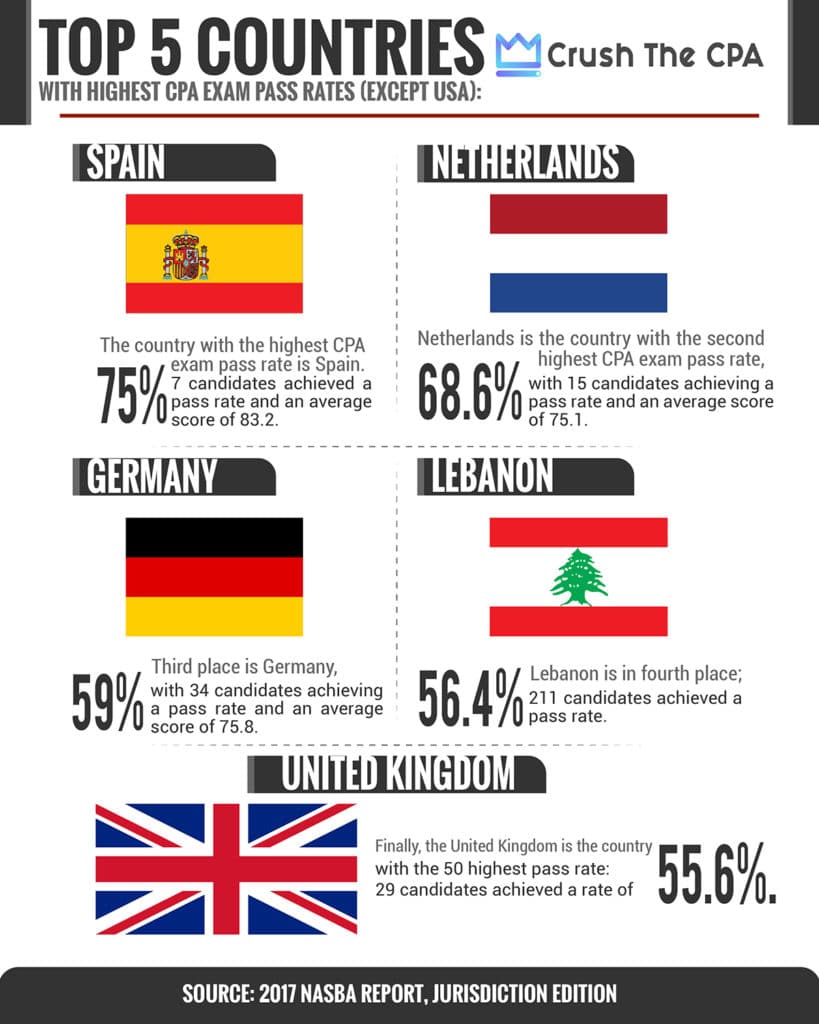

Countries with the Highest CPA Exam Pass Rates

So far, these CPA exam statistics have mostly involved the United States. This makes sense when considering the fact that the vast majority of CPA candidates live in the USA. According to page 131 of the 2017 NASBA Report, Jurisdiction Edition, there were 85,981 domestic CPA candidates and only 9,802 international CPA candidates, making up about 10% of all CPA candidates.

However, something that becomes clear when studying the data from individual colleges and states is that a higher population doesn’t necessarily mean greater success. After all, the domestic candidate pass rate is 49.5% and the cumulative international pass rate is 38.3%. However, neither of these pass rates even come close to those of the top five countries:

What does this data tell us? Are Spaniards naturally gifted in the art of public accounting, or are the smaller numbers throwing these metrics somewhat out of proportion? After all, a country with a 75% pass rate is extremely impressive, especially for an exam as difficult as the Uniform CPA Examination. However, the fact that this stat is pulled from a group of 7 people takes some of the wind out of those sails. Essentially, the most significant thing these statistics tell us is that the countries with the most selective pools of candidates tend to achieve the highest rates of success.

CPA Employment Statistics

Although it can be helpful to look at statistical data around the CPA exam, that’s only a small piece of the full picture. In order to gain the most insight possible into the profession of public accounting, we need to look at what happens after you pass the CPA exam and become certified.

Average CPA Salary

What’s the average salary for a Certified Public Accountant? Well, depending on who you ask and where you look, the answer to this question can vary. But here’s what we found:

According to Payscale, the average annual salary for someone working as a CPA is $65,397. Glassdoor lists the average salary for a working CPA as $67,221. Both are fairly close to each other and combine to form a cumulative average salary of $66,309.

What’s interesting is that Payscale also lists a much higher average salary for individuals who have a CPA certification: $84,000. The reason why this number is higher than that of working CPAs is it includes other careers that require CPA certification, such as Senior Accountants, Financial Controllers, and CFOs.

Male vs. Female Accountant Salaries

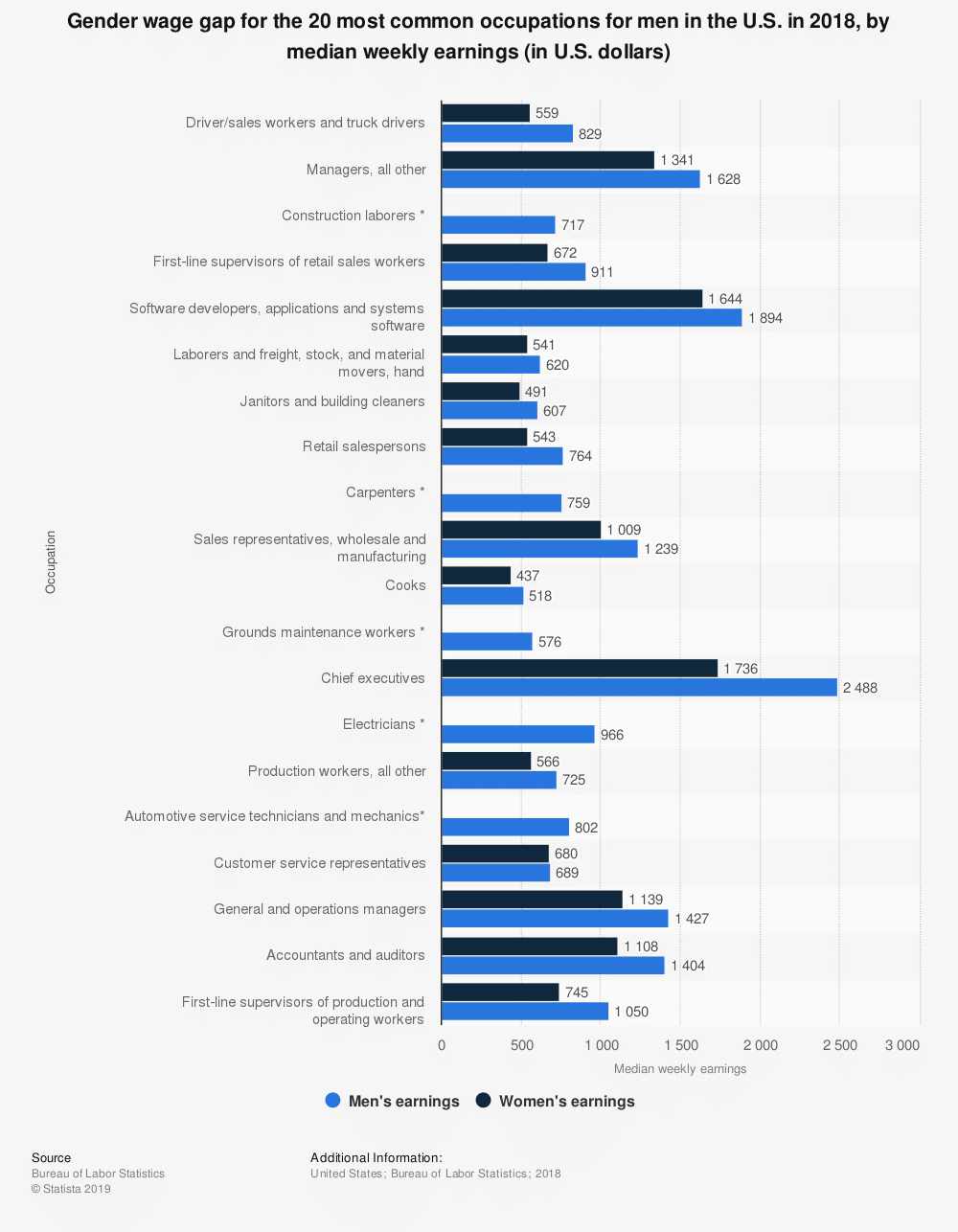

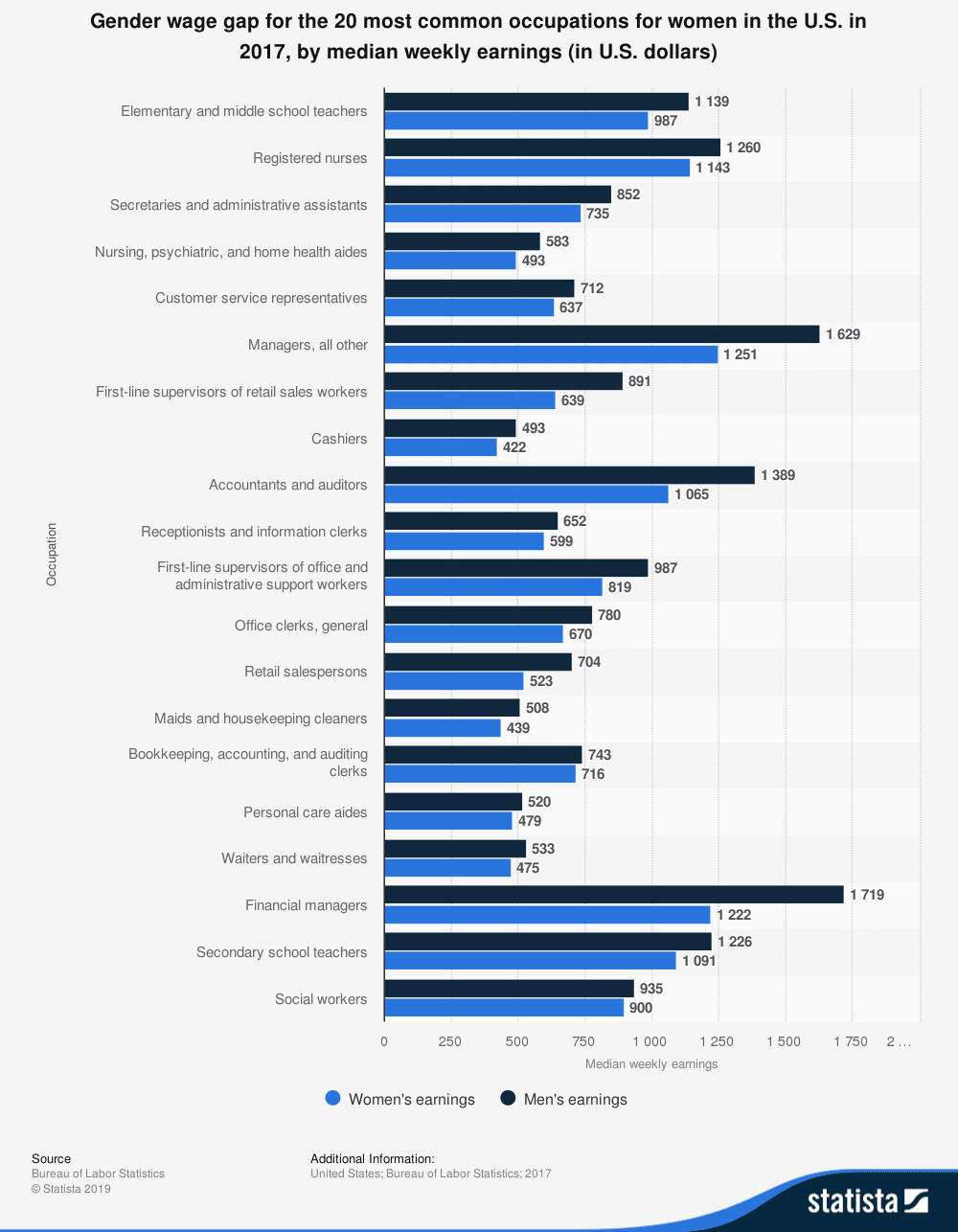

Based on statistics gathered and published by a data aggregator, it appears that there’s a gender pay gap in professional accounting. Although it doesn’t specifically mention CPAs or CPA certified professionals, charts found on Statista based on data from 2017 and 2018 show that on average, male accountants have higher salaries than female accountants.

Previous

Next

Obviously, this is less than ideal and the industry would be far better off if earnings were equal regardless of gender; this is clearly an issue that needs fixing. However, there is a silver lining:

In 2017, male accountants made roughly $324 more than female accountants per week. In 2018, this gap shrunk to $296 per week. Hence, it appears that this gap is slowly but surely shrinking!

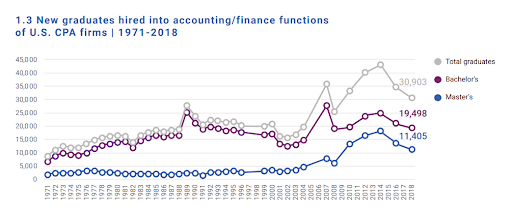

Education Level of CPA Hires

Aside from CPA certification, what level of education do most CPA firm hires have? To answer this question, we’ll need to return to that AICPA report on accounting graduates from earlier. This graph from page 7 of their report offers the information we’re looking for:

There are two interesting takeaways from this data. First, the majority of graduates hired to CPA firms are Bachelor’s degree holders, with 19,498 hired in 2018. As previously mentioned in the section on common education programs for candidates, this is the path of least resistance to a career in public accounting. However, the second takeaway is what makes this so interesting. Over the past 15 years, Master’s degree holders became the second most often hired group of graduates for CPA firms, from 3,555 hired in 2003 to 11,405 hired in 2018. This relatively recent development is fascinating and raises several implications.

Male vs. Female CPA Hires

Is there a gender gap in CPA hires? Here’s what the AICPA has to say on page 20 of their 2019 trend report:

Out of the 30,903 Bachelor’s and Master’s degree graduates hired at CPA firms in 2018, 49% were male and 51% were female. That means that any semblance of a gender gap, minor as it may be, would be skewed towards women.

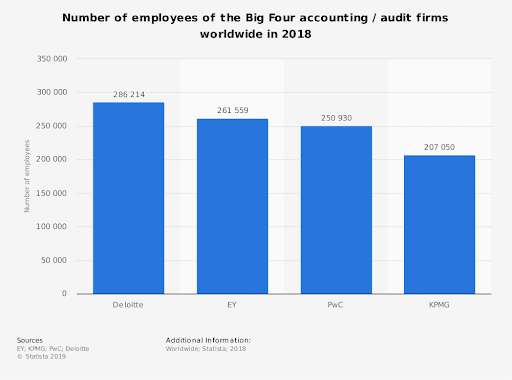

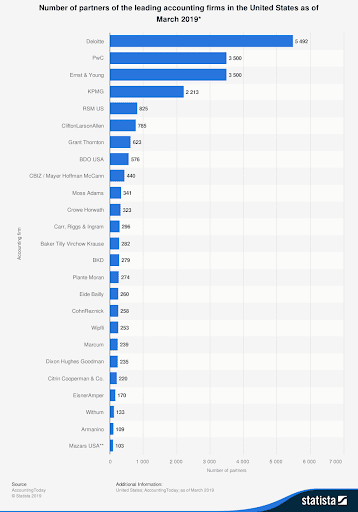

Largest CPA Employers

Who are the biggest employers of Certified Public Accountants? The answer to this question is the top four biggest and most successful accounting firms in the world, commonly referred to as the Big 4. From largest to smallest, these four firms are Deloitte, PwC, Ernst & Young, and KPMG.

Considering the fact that the Big 4 are the largest accounting firms in the world, it makes sense that they would hire the majority of professional accountants and auditors. According to additional data gathered by Statista, here are the total number of employees working at each company in 2018:

To be fair, some information is missing that prevents this chart from painting a clear picture. Notice that Ernst & Young has more employees than PwC, despite being an arguably smaller accounting firm. But the biggest criticism to this statistic is that it doesn’t specifically track accountants working for the Big 4.

That’s where this next data chart from Statista comes in:

This chart lists the number of partners at each firm, which weeds out most non-accounting employees and more evenly correlates to the size of each firm. Although neither of these charts are able to provide a full picture, they do an adequate job when combined.

Best States and Cities for Accounting Employment

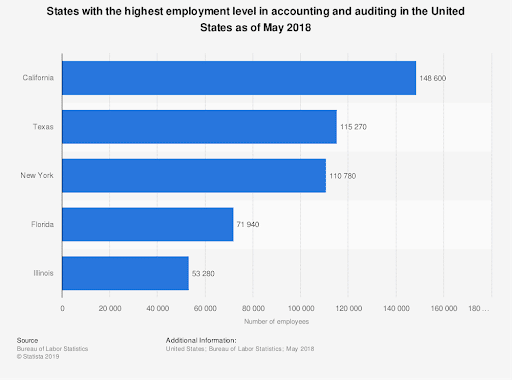

Which state in America hires the most accountants? If you’re interested in moving to the area with the most employment opportunities, this Statista chart has the information you’re looking for:

Unsurprisingly, two of the largest and most economically productive states are among the highest employers of accountants and auditors in 2018: California with 148,600 employees and Texas with 115,270 employees.

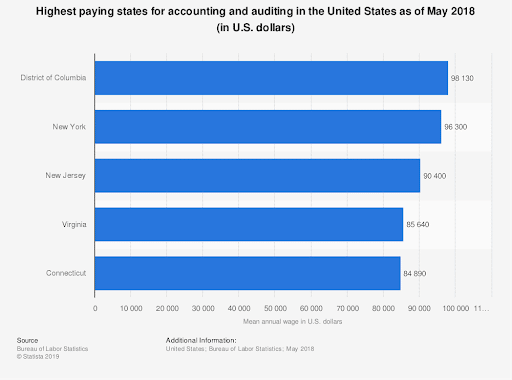

But what if you’re interested in quality over quantity? If you’re more interested in pursuing an environment with higher-paying positions, here’s another Statista chart with answers to this question:

Notice something interesting? Perhaps due to the economic law of supply and demand, neither of the two states with the highest employment made this list. Instead, the highest-paying state for accountants and auditors is the District of Columbia (D.C.), with an average annual salary of $98,130. Interestingly, the state with the third highest employment rates for accountants and auditors, New York, is also the second highest-paying: 110,780 professionals in 2018 with a cumulative average wage of $96,300 a year.

Recent CPA Career Growth

How has the public accounting industry grown over the past few decades? Furthermore, what can this information tell us about the future of CPAs? Here are some more fun numbers that can shed some light on these queries:

Based on the table from earlier, we can see that the number of Bachelor’s and Master’s degree holders hired to CPA firms has increased greatly since the 1970’s. However, there seems to have been a spike around 5 years ago with an all-time high of 43,252 graduates hired in 2014. This number has since decreased to the previously mentioned 30,903 graduates hired in 2018.

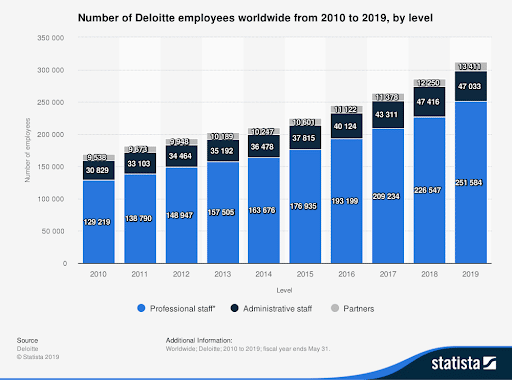

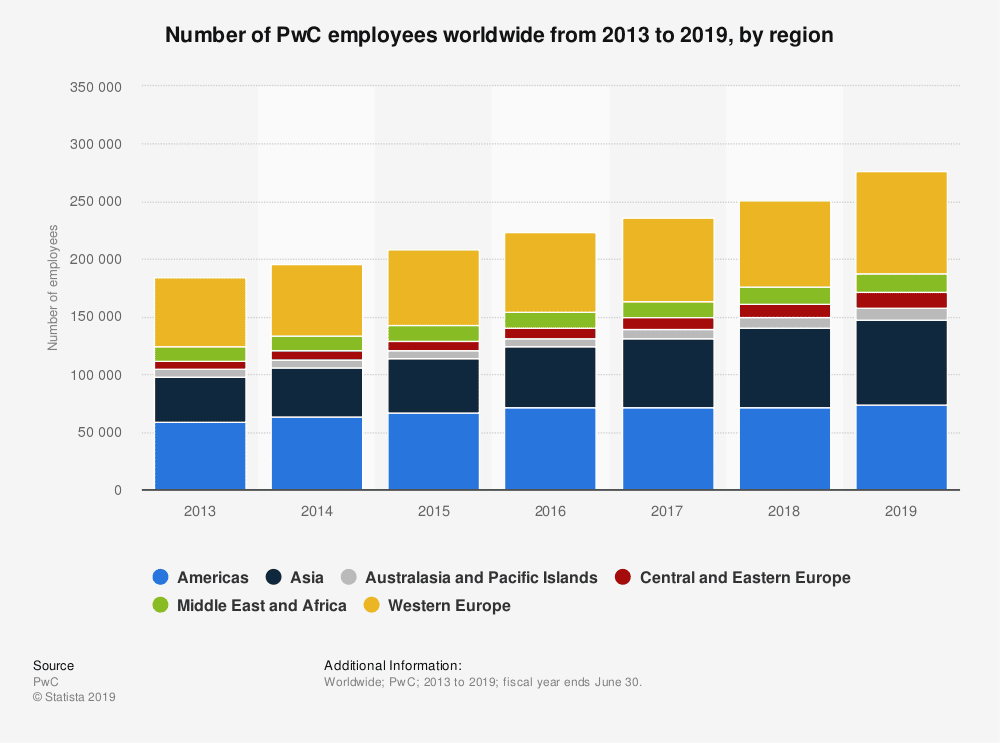

What’s interesting about this downward trend is that it doesn’t seem to have affected the Big 4 accounting firms or their hiring practices. Take a look at these two graphs from Statista regarding worldwide hiring rates for Deloitte and PwC:

Previous

Next

The first graph shows that Deloitte hired 225,351 employees in 2015 and 312,028 in 2019: an approximate 39% increase over the five-year period. The second shows that PwC hired 208,109 employees in 2015 and 276,005 in 2019, which is an approximate 33% increase over the five-year period.

As you can see, both of these huge accounting firms have continued to hire more and more professionals over the past five years despite the drop in overall hires across the industry. When comparing this information with the data provided by the AICPA, there seems to be a discrepancy between the two that demands further investigation.

Future CPA Career Growth

How does the future look for CPAs and other professional accountants? According to the data we found, it looks very bright!

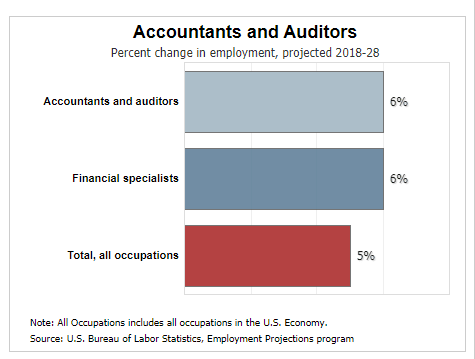

Once again, this is a case where gathering broad data points from different sources helps us to create a clear picture of the situation. Starting with data gathered by the Bureau of Labor Statistics, they predict that employment for professionals working as auditors and/or accountants will grow by 6% over the next ten years.

Additionally, notice the comparison to growth projections for all occupations in the same time span: only 5%. Consequently, it appears that accountants and auditors will outpace the positive effects of consistent economic growth, making it a genuine growth industry.

However, there are two obvious limitations to this data. First, this chart tracks both accountants and auditors. Second, it tracks all accounting professionals— not just CPAs. Because of that, these numbers are diluted and don’t provide the clearest picture of CPA employment trends.

The Big Picture

Before we dive into the major lessons we can learn from these NASBA reports, let’s go over every single statistic covered in this article:

Needless to say, that’s a lot of information to take in all at once. Hence, it can be difficult to understand exactly what there is to learn from all this data. To make this easier, here are some key takeaways for all aspiring CPA candidates to keep in mind:

Focus on FAR and AUD, But Don’t Neglect BEC

When studying for the CPA exam, the content areas you’re going to want to spend the most time studying are those related to the Financial Accounting and Reporting section of the exam. This is the toughest CPA exam section for the majority of candidates. The Financial Statement Accounts-related questions and the Task-Based Simulation section in particular are among the most difficult based on the numbers.

Furthermore, it’s a good idea to devote some extra study materials and time towards understanding Auditing and Attestation questions as well. After all, AUD’s Forming Conclusions and Reporting content area is the toughest to pass out of all content areas in all sections of the CPA exam.

Since BEC is considered the easiest section to pass, you might be tempted to take it easy when going over study materials related to it. However, this is not a good idea, since you run the risk of being unprepared and blowing your chances of a passing grade. That being said, if you find yourself in a situation where you only have so much time to finish studying and you can only pick one section, make it FAR.

Take the Test When You’re Young

The time in your life when you’re most likely to pass the CPA exam is in your early 20s. Therefore, if you’re still in college or a recent graduate, this is the best time to schedule your CPA exam test dates if you want the highest probability of a passing grade. This doesn’t mean that you won’t be able to pass the test if you’re older and have been out of college for several years. However, the odds of you passing do tend to drop off sharply once you enter your mid-to-late 30s.

Apply For a Southern or Midwestern University

Admittedly, there’s a bit of fuzzy math that went into these findings. However, there certainly are a large number of universities in these regions of the United States that provide impressive business and accounting accreditations. Consequently, many students of these universities tend to have higher CPA exam pass rates.

As previously mentioned, colleges in Iowa and Virginia have impressive pass rates; several are found in the top 40 ranked universities for students who pass the CPA exam. However, many of these top schools are highly selective when it comes to their accounting programs, so you might not be accepted. Therefore, it’s not a bad idea to hedge your bets with applications to accounting and business programs in Texas or Missouri.

At the very least, aim for a college with an accounting program that has AACSB-A accreditation. If they only have AACSB accreditation, that’s not so bad; however, that extra A at the end adds a whopping 6% to your chances of achieving a passing grade!

Consider Post-Grad Education

Consider the growing trend of Master’s degree holders being hired at CPA firms over the past fifteen years. It’s possible that this increase in education can be due to a previously made point in the section on CPA education statistics; Master’s degree holders are planning on working their way up to higher management positions, with CPA work as their entry level.

However, there’s another potential reason for this increase, and it has to do with the increasing complexity of the field of public accounting. It’s possible that due to the advancement of tech relating to accounting and auditing (such as the blockchain) could be inspiring accountants to further their education in order to capitalize on these changes or simply keep up with the competition. So if any of these points apply to you, consider going for your Master’s instead of simply settling for a four-year degree.

Consider Employment Outside the U.S.

As previously mentioned in the section on CPA career growth, the overall hiring rate for Bachelor’s and Master’s degree graduates decreasing according to the AICPA has decreased over the last five years. However, the Big 4 accounting firms have increased their hiring rates over the same time period. What gives?

Perhaps the reason for these two phenomena has to do with the consolidation of these four firms. As they grow over the years, smaller local accounting firms are either acquired by one of the Big 4 or pushed out of business due to an inability to compete. This would explain the shrinking employment pool for United States graduates who have fewer potential employers in their country of origin.

On that note, it’s important to note that the AICPA report only tracks Bachelor’s and Master’s degree graduates in the U.S. Therefore, it’s entirely possible that the decreased hiring pool is exclusive to that country, with the global hiring rate for professional accountants increasing alongside the Big 4. This hypothesis is further reinforced by additional information contained in the above chart tracking PwC’s global hiring rates.

Ultimately, PwC hired more employees in non-American regions: 88,064 in Europe and 73,856 in Asia compared to only 73,801 in the Americas. And although this information isn’t contained in the graph tracking Deloitte’s employment numbers, it’s a fair bet that they have similar numbers. For that reason, consider looking for employment outside of the United States. Perhaps the grass really is greener on the other side!

Don’t Worry Too Much About the Numbers

After filling your head with all these numbers and percentages, there’s one last important lesson to be learned: Don’t let the numbers freak you out!

It’s true that statistics can greatly inform our decisions and increase our chances of success in a variety of situations. However, the law of averages doesn’t guarantee you’re going to get the results you’re looking for. While that may sound depressing, it also means the reverse is true; you’re not doomed to failure if the numbers are against you!

Ultimately, if you want to become a Certified Public Accountant, the best way to achieve that goal is to work towards it every day. Learn more about the CPA exam itself, sign up for a CPA review course, and figure out your own foolproof study plan. Taking these actions will have a much greater effect on your chances of passing the exam than looking at any statistics. Get started today!

Bryce Welker is a regular contributor to Forbes, Inc.com, YEC and Business Insider. After graduating from San Diego State University he went on to earn his Certified Public Accountant license and created CrushTheCPAexam.com to share his knowledge and experience to help other accountants become CPAs too. Bryce was named one of Accounting Today’s “Accountants To Watch” among other accolades. As Seen On Forbes