So, you’re ready to tackle the CPA exam? Great choice! Let’s talk about getting through that application process without pulling your hair out. It’s pretty much the same drill in every state, but there are always those tiny details that can trip you up.

Get it right, and you could be sitting for your first exam section in about a month or so. But miss a small step? Well, that’s when things can get a bit annoying.

I’m here to help you cut through the clutter that can come with passing the CPA exam! Think of this as your no-nonsense guide to breezing through the CPA exam application. I’ll cover everything from the nitty-gritty of fees and forms to what you need to send and where. And hey, I’ll even talk about those pesky little things like scheduling your exam and making sure your transcripts are in order.

The goal? To get you from ‘application’ to ‘approved’ without the headache. That way, you can focus on the real challenge – studying for and smashing that CPA exam. So, grab a coffee, and let’s get you on your way to becoming a CPA pro!

CPA Exam Requirements: Are You Eligible?

You must first qualify before you can apply for the Uniform CPA examination. This involves making sure that you have met all of your state requirements to sit for each CPA exam section. You can check your individual state requirements here.

You are officially eligible to start the application process once you have met all of the Uniform CPA exam qualifications. This can be a complicated ordeal if you accidentally skip a step or do it out of order, so my goal is to simplify this process for you.

The steps to submit CPA exam application forms and documents below are listed in chronological order and include links to necessary resources as well as valuable tips I learned from my own experience. This experience fuels my mission to help other CPA exam candidates get through the process as painfully as possible.

The steps to submit CPA exam application forms and documents below are listed in chronological order and include links to necessary resources as well as valuable tips I learned from my own experience. This experience fuels my mission to help other CPA exam candidates get through the process as painfully as possible.

How To Apply For The CPA Exam

1. Gather and Submit All Official School Transcripts

- Institutions to Include: Ensure you include transcripts from all educational institutions you’ve attended – colleges, universities, community colleges, and private institutions.

- Timing: Submitting these as soon as you meet your state’s CPA exam education requirements is advisable. This proactive approach can significantly expedite the application process.

- Verification: Double-check that the transcripts reflect all the courses and credits your state board requires.

- If an educational evaluation fee is required, submit that as well.

2. Submit Your CPA Exam Application and Pay the Fee

Once you’ve completed the application and gathered all necessary documentation, submit these along with the application fee to your state board. This is typically $100-$200 per state. This can usually be done online, though some states may still require a paper submission.

Ensure you keep copies of all documents and confirmations of submission for your records.

3. Receive Your Authorization to Test (ATT) from your State Board

One of the critical steps is understanding the Authorization to Test (ATT) and its validity period. This understanding is crucial as it directly impacts your exam scheduling and preparation strategy.

What is the ATT?

The ATT is an official document that signifies your eligibility to sit for the CPA exam. It is issued by your State Board of Accountancy after your application is approved.

- Validity Period of the ATT

- The standard validity period for the ATT is 90 days in most states. This means you have a 90-day window from the date of issuance to select which sections of the CPA exam you wish to sit for.

- It’s important to act within this period. If you fail to schedule your exam sections within these 90 days, you risk forfeiting your application fee.

- State-Specific Variations

- While the 90-day rule is common, some states may have different timelines. For example:

- States with a Six-Month NTS: Many jurisdictions have a six-month Notice to Schedule (NTS) validation period. This period is crucial as it dictates the timeframe within which you must schedule and take the examination section(s).

- Extended Periods in Certain States: Some states offer extended periods for the NTS. For instance, California, Hawaii, Louisiana, and Utah provide a nine-month period from the NTS issue date. North Dakota, South Dakota, and Virginia extend this period to 12 months.

- These variations can significantly affect your planning. For example, if you are in a state with a 12-month NTS period, you have more flexibility in scheduling your exams compared to a state with a standard six-month period.

- While the 90-day rule is common, some states may have different timelines. For example:

- Strategic Planning Based on ATT Validity

- Understanding the ATT validity period is essential for strategic planning. If you’re in a state with a shorter validity period, you might want to schedule exams closer together.

- Conversely, in states with longer validity periods, you have the luxury of spreading out your exam dates, which can be beneficial if you need more study time or have other commitments.

- Recommendations for Candidates

- Check Your State’s Specific Rules: Always verify the specific rules and timelines for the ATT and NTS in your state. This information can typically be found on your State Board of Accountancy’s website or by contacting them directly.

- Plan Accordingly: Based on your state’s validity period, plan your study schedule and exam dates. This planning helps ensure that you are fully prepared for each section without the risk of losing your fees due to expired ATT or NTS.

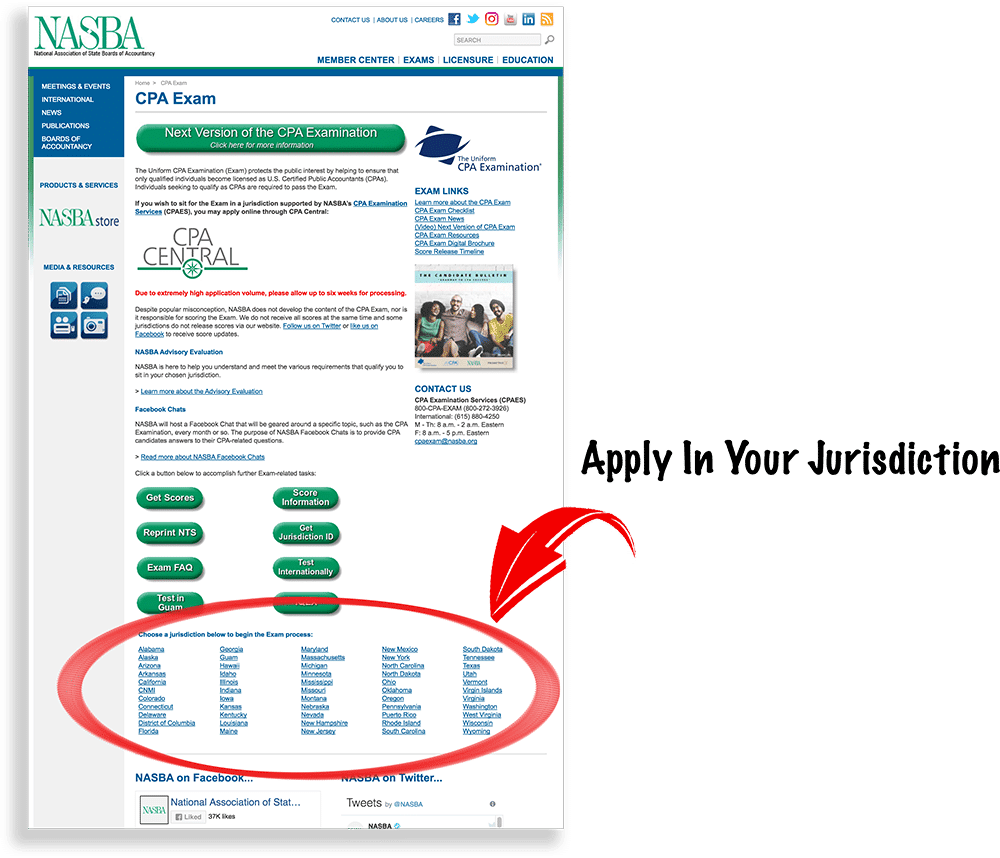

4. Receive your Notice to Schedule (NTS) from NASBA

A Notice to Schedule (NTS) is your official document that authorizes you to sit for the CPA exam in the United States. Couple notes about your NTS:

- Typically this takes between 3-6 weeks to receive, however, certain states allow you to apply online and get it the same day (my California NTS took 5 weeks)

- Each state has a NTS “validation period” which essentially means you have a time limit to take all the exams that you have paid for in STEP #3! This is totally unfair, and it’s obvious why they would do this, $, but rather than complain I’d rather help you avoid their trap. Don’t pay for for all four sections if you don’t think you can study and sit for all four within that six month period or you will forfeit your money for any untaken tests. If you have a busy schedule, it is much cheaper to schedule and pay for 2 sections, then reapply for the next two sections six months later (reapplication fees are generally around $50, which is much better than a few hundred dollars).

“Boards of Accountancy will set a time period for which an NTS is valid (generally six months) during which you must schedule and take the examination section(s), after which it will expire and all fees will be forfeited.” – NASBA

- All jurisdictions have established a six-month NTS validation period, except for the following jurisdictions:

- Texas 90 days from application date

- California 9 months from NTS issue date

- Hawaii 9 months from NTS issue date

- Louisiana 9 months from NTS issue date

- Utah 9 months from NTS issue date

- North Dakota 12 months from NTS issue date

- South Dakota 12 months from NTS issue date

- Virginia 12 months from NTS issue date

5. Go to the Prometric Website and Schedule Your Exam

- Click the “Schedule My Test” button and choose the state you want to test in

- Enter the exam section ID and first 4 letters of your last name

- From here you will be able to choose the date, location, and section of the exam(s) you wish to take

Understanding CPA Exam Fees: A General Overview

To learn about Testing Windows and find out what months you are not allowed to sit for the CPA exam click here.

CPA Exam Rescheduling Fees:

- 30 days or more in advance: no penalty

- 5-30 days in advance: $35

- 1-5 days in advance: you will be charged the FULL price of the exam

- Less than 24 hours before exam: rescheduling is not allowed, you must reapply

*I would suggest that you schedule your exams at least 3-4 weeks in advance

Applying for and taking the CPA exam involves various fees, which can vary depending on the state in which you are applying. It’s important to have a clear understanding of these fees as part of your exam preparation and budgeting.

- Examination Fees

- These are the fees paid for each section of the CPA exam.

- Per section, fees generally range from $175 to $400 depending on your state

- It’s important to note that these fees are paid to NASBA (National Association of State Boards of Accountancy) and are separate from the application fee.

- Rescheduling Fees

- If you need to reschedule an exam section, there may be additional fees.

- These fees vary based on how far in advance you reschedule. Rescheduling more than 30 days in advance typically has no penalty, while rescheduling 1-5 days before the exam can incur a fee equivalent to the full price of the exam section.

- Other Potential Costs

- Prometric Fees: Some states may have additional fees for scheduling exams at Prometric testing centers.

- Reapplication Fees: If you need to retake a section, you may have to pay a reapplication fee, which is generally lower than the initial application fee.

6. Take Your CPA Exam!

You MUST bring your Notice to Schedule with you to the Prometric testing center or you will not be able to take your exam! (I made this mistake once but luckily was able to race home, grab it, and get back in time to take it.. my Toyota Corolla has never driven so fast!)

You are also required to present two forms of identification at the test center, one of which must contain a recent photograph. Each form of ID must bear your signature and cannot be expired.

Related Blog Posts & Resources

CPA Application Tips and Information

- You are not restricted to taking the exam in your state and are allowed to take it at any Prometric location.

- Once you pass your first CPA exam section, you have 18 months to pass the remaining three sections. This number is changing in certain states as the NASBA recently changed their recommendation to a 30-month limit.

- You may apply to any state or jurisdiction, but can only register to take the exam in one jurisdiction at a time.

- Applications can be submitted at any time during the year.

- Make sure the name on your application exactly matches the name on the two forms of ID you will use at the testing center.

Don’t Wait For Your NTS, Start Studying Today!

You can waste weeks of valuable study time waiting for your Notice to Schedule. Use that time to get a head start on the section you want to tackle first and jump on it today. No excuses, no more procrastinating, just do it!

Be sure to check out my top 5 CPA courses on the market in this side-by-side CPA review course comparison to find out which one is the best fit for you.

FAQs

Eligibility varies by state, but generally includes educational requirements (often 150 credit hours with a certain number of accounting and business courses), passing an ethics exam, and sometimes work experience. Check your state’s specific requirements for detailed information.

The application process involves submitting an application to your State Board of Accountancy, paying an application fee, and providing necessary documentation like official school transcripts. The process may vary slightly by state.

Application fees typically range from $100 to $200, varying by state. Additionally, there are separate fees for each exam section, generally ranging from $175 to $400 per section.

Yes, each state may have different rules and timelines. For example, some states have a six-month Notice to Schedule (NTS) validation period, while others offer extended periods.

The ATT is a document that signifies your eligibility to sit for the CPA exam, issued by your State Board of Accountancy. Its standard validity period is 90 days in most states, during which you must select your exam sections.

The NTS is an official document from NASBA that authorizes you to schedule and sit for the CPA exam. You’ll receive it after your application is approved, usually within 3-6 weeks.

To apply for the NTS, you first need to submit your CPA exam application to your State Board of Accountancy and pay the required fees. Once your application is approved, the NTS will be issued to you by NASBA.

The time to receive your Notice to Schedule (NTS) can vary, but typically it takes between 3 to 6 weeks after your application is approved. Some states offer faster processing times, allowing you to receive the NTS more quickly.

The validity period of the NTS varies by state. In most states, the NTS is valid for 90 days, while some states offer a six-month validity period. Certain states like California, Hawaii, and Utah have extended periods of up to 9 or 12 months.

Once you receive your NTS, you can schedule your CPA exam sections through the Prometric website. Enter your NTS number, section ID, and personal details to select your preferred date and testing location.

The section ID is a unique identifier for each of the four sections of the CPA exam (AUD, BEC, FAR, REG). It is provided in your NTS and is used when scheduling your exam sections at a Prometric testing center.

The duration of the CPA application process can vary based on several factors, including the processing time of your State Board and the completeness of your application. Generally, it can take a few weeks to a couple of months.

You must bring your Notice to Schedule and two forms of identification to the Prometric testing center. One ID must contain a recent photograph, and both should bear your signature and not be expired.

Once you pass your first CPA exam section, you have 18 months to pass the remaining three sections.

Yes, you are not restricted to taking the exam in your state and can take it at any Prometric location.

You may apply to any state or jurisdiction, but you can only register to take the exam in one jurisdiction at a time.

Rescheduling fees vary based on the notice period. Rescheduling more than 30 days in advance typically has no penalty, while rescheduling 1-5 days before the exam can incur a fee equivalent to the full price of the exam section.

Bryce Welker is a regular contributor to Forbes, Inc.com, YEC, and Business Insider. After graduating from San Diego State University, he went on to earn his Certified Public Accountant license and created CrushTheCPAexam.com to share his knowledge from reviewing hundreds of accounting courses while helping thousands of other accountants become CPAs. Bryce was named one of Accounting Today’s “Accountants To Watch” among other accolades. As Seen On Forbes